Table Of Content

- American Art Week at Bonhams in November

- Jewelry Bought by Steve Mcqueen for First Wife Neile Adams Mcqueen, Heads to Bonhams California Jewels Sale

- OFFICIAL NOTICES AND PUBLICATIONS

- MELLO-ROOS AND COUNTY IMPROVEMENT DISTRICTS

- Los Angeles County, CA Homes on Auction

- Under the Hammer Meaghan Roddy's Top Picks from Modern Design Art

- Sorry, you have been blocked

The County has many opportunities for bidding and purchasing of land, cars, equipment or personal property. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Personal propertyItems owned by the decedent at time of death, such as cash, stocks, jewelry, clothing, furniture, or cars. Intestate successionThe order in which heirs inherit the decedent’s estate when a person dies without a Will. EscrowA contractual arrangement in which a third party (title company or escrow company) receives and disburses money or documents related to the sale of a property.

American Art Week at Bonhams in November

For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and up-to-date information, or contact the county tax collector's office directly. Below is a link to each county's tax collector’s website, which contains county services and contact information. Additionally, some counties may also list their sales directly at Bid4Assets.com.

Jewelry Bought by Steve Mcqueen for First Wife Neile Adams Mcqueen, Heads to Bonhams California Jewels Sale

Creditor’s ClaimA written claim filed by a person or entity owed money by a decedent. AdministratorThe person responsible for overseeing the distribution of the estate, and may also be referred to as the “Personal representative”. BeneficiaryA person designated by the decedent who inherits under a Will. Secured Property Tax Information Request formA form to request information on multiple properties all at once.

OFFICIAL NOTICES AND PUBLICATIONS

For example, the Office of the Assessor calculates property taxes based on the assessed value of a property. This article will focus of just a handful of the best auction houses in California. Real propertyBuildings and land, including the residence owned by the decedent at the time of death. If you are traveling outside of California on the hunt for auction houses, view ‘The Best Auction Houses in the United States’.

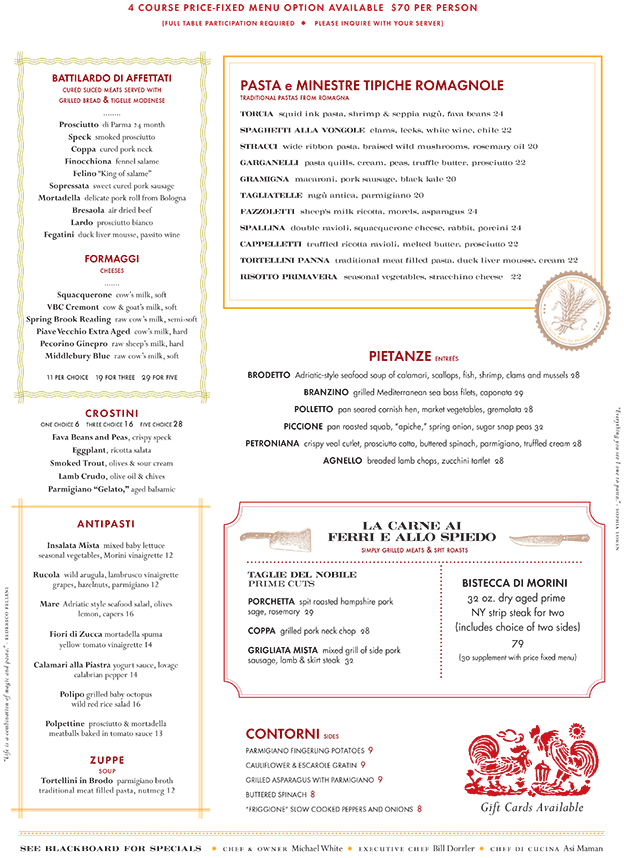

Since the first auction house opened in Sweden in 1674 they have grown in popularity and can now be found in the majority of countries around the world. In particular, auction houses have become common across the entirety of the United States. Some auction houses only buy and sell specialty items such as art works while others have a broader selection. We offer a full range of auction and appraisal services with 58 specialists based in California, representing more than 30 collecting categories. Before you click the button, check the bank routing number and the bank account number to make sure you have entered each correctly.

Supplemental Secured Property Tax BillAn additional tax bill issued as a result of the reassessment of the value of a property upon a change in ownership or completion of new construction. Reassessment ExclusionA taxpayer’s request to be excluded from reassessment of the value of a property after meeting certain conditions (e.g., transfer of property from parent/grandparent to child/grandchild or transfer of base year value). Electronic CheckAn electronic form of payment made via the Internet that is designed to perform the same function as a conventional paper check. The Treasurer and Tax Collector’s Online Auction will be held in April 2024, at /LosAngeles.

Ogdensburg to auction off 15 properties seized for unpaid taxes - WWNY

Ogdensburg to auction off 15 properties seized for unpaid taxes.

Posted: Mon, 22 Apr 2024 20:13:00 GMT [source]

Additionally, the USPS may not postmark mail on the same day it is deposited by a taxpayer. Military OrdersThe documentation required for military personnel to apply for relief of property tax penalties. A payment is late if the Treasurer and Tax Collector does not receive your payment by the delinquency date, or if the United States Postal Service does not postmark your payment on or before the delinquency date. If the delinquency date falls on a Saturday or Sunday, by law, the Treasurer and Tax Collector extends the delinquency date to the close of business on the next business day.

Service FeesA charge for processing all credit/debit card transactions for property tax payments. Freeman’s auction house began in 1805 claiming it’s name as the oldest auction house in America. Their team specializes in jewellery, fine art and antiques making it a great place for a range of buyers such as private collectors, corporations and museums. Each year Freeman’s hold twenty auctions and also allow live internet bidders which makes it great for those who are unable to make it in person.Find out more about Freeman’s Auction Houses. Auction houses; a term used for companies that assist with both buying and selling of items as well as the place in which an auction will take place.

Property Tax PostponementA State program offered to senior, blind, or disabled citizens to defer their current year property taxes on their principal residence if they meet certain criteria. Impound/Escrow AccountAn account a taxpayer establishes with his/her lender to pay property taxes. Get a free auction estimate by submitting your item online or contacting your local Bonhams. With specialists based in towns and cities worldwide, we are your local auction house. Decedent’s estateAll the property (home and/or personal effects) that a person owned at the time of death. Taxpayers who send their payments by mail are cautioned that the USPS only postmarks certain mail depending on the type of postage used.

Public auctions are the most common way of selling tax-defaulted property. The auction is conducted by the county tax collector, and the property is sold to the highest bidder. Five-Pay Plan A five-year payment plan that allows defaulted property taxes to be paid in 20 percent increments of the redemption amount, with interest, along with the current year property taxes annually. The County sells surplus property to the public and also runs an online service that allows the public to exchange their surplus materials. The County sells surplus equipment and furniture to the public when it becomes available, listing the items on a website operated by Internal Services.

The item is retained in USPS custody and is not handed back to the customer. ReassessmentThe rate or value of a property when a change in ownership or completion of new construction occurs. Personal Identification Number (PIN)An alphanumeric code necessary for completing electronic financial transactions. Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. WillA legal document that lists a person’s wishes about what will happen to his/her estate after death.