Table of Content

It’s small distinctions like this that can cause insurance agencies to deny a claim. Shield your home from further damage by making temporary repairs, if needed. What if you have an incident where you're not sure whether to file a claim? There are several things you can do to better secure your home against strong winds, according to FEMA.

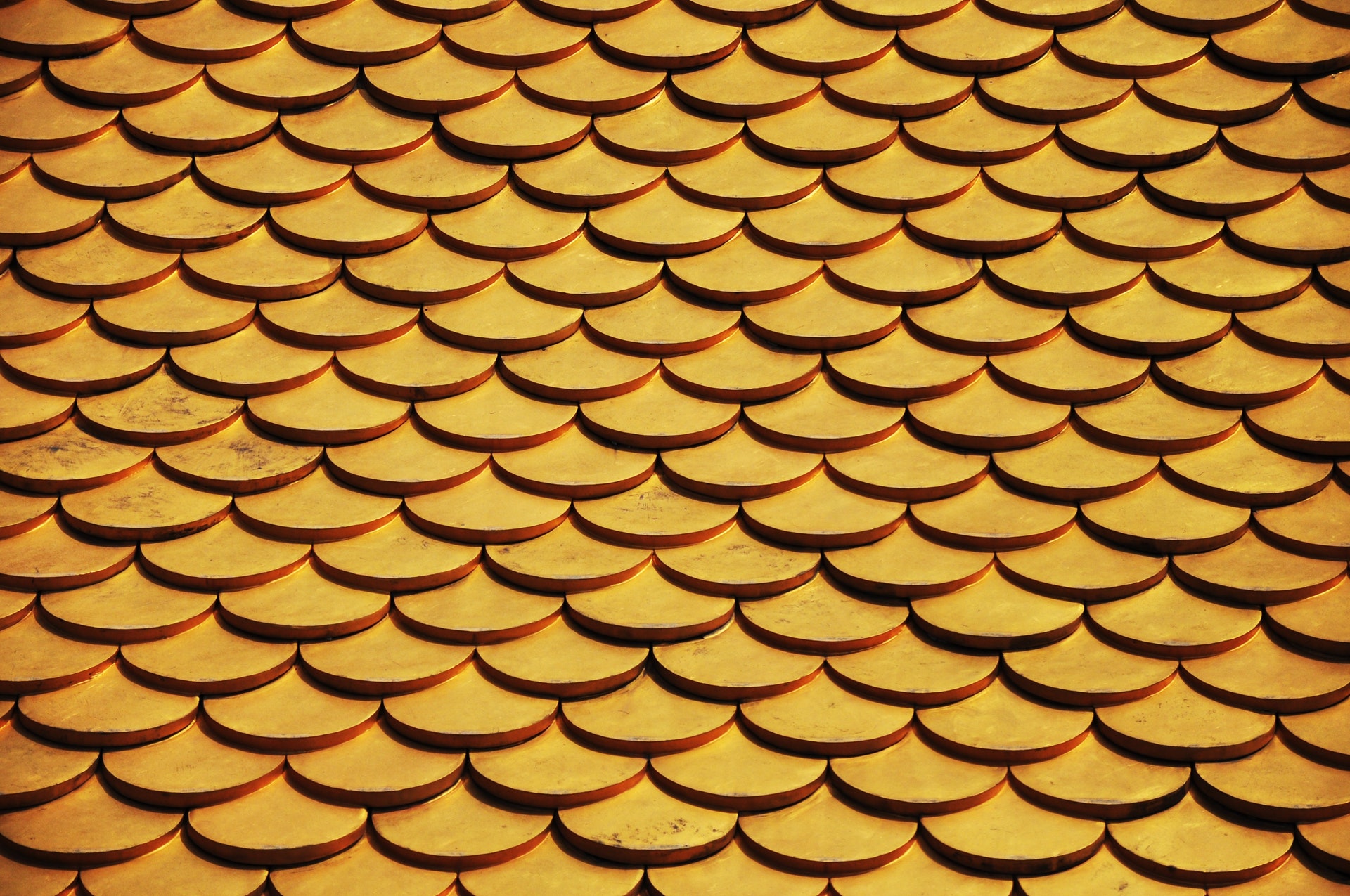

Not only does it establish a pleasing aesthetic, but it also protects the more vulnerable wood that makes up its interior structure. Whether vinyl or metal, your policy should cover siding if it was damaged during a storm. Furthermore, damage from a falling tree, branches, or other objects carried or toppled by strong winds should be classified as wind damage by your insurance carrier. Winds can toss lawn furniture, splinter branches, and sometimes even topple decades-old trees to the ground. It’s no surprise that they can also damage the exterior of your home—peeling shingles from roofs, ripping up siding, even shattering windows. Policygenius Inc. (“Policygenius”), a Delaware corporation with its principal place of business in New York, New York, is a licensed independent insurance broker.

Does homeowners insurance cover tornado damage?

Gusty winds aren’t the only thing blowing your insurance rates out of the water. When hurricanes practically send the ocean inland, large waves can flood basements, rip houses completely out of their foundation, and cause tens of millions of dollars in property damage. Make sure you’re covered for the damage before you spend countless hours battling for repair costs. Take into account your type of coverage as well–replacement cost vs. actual cash value–to make sure you’re getting what you deserve. If wind knocked over a tree in your yard but the tree didn’t cause any damage to your covered property, your insurance company will not pay you for the removal or replacement of the tree.

With Virginia’s proximity to several bodies of water, it’s important to purchase a homeowners insurance policy that includes coverage for severe weather events. Insurance policies list the maximum amount they will pay for a covered loss. For instance, a home that is insured for $200,000 has a coverage limit of $200,000. If a hurricane hits a home and it is demolished, the maximum amount that the insurance company will pay to repair or replace the home will be $200,000, minus any deductible.

Types of wind damage covered by home insurance

This includes not only hurricane or tornado damage, but wind damage caused by any strong storm or other source (thunderstorms, hailstorms, etc.). Say your home is insured for $300,000 and you have a wind and hail deductible of 5%, you’d have to pay $15,000 (300,000 x 0.05) before you’d be covered for a wind and hail-related loss. A higher percentage can lower the cost of homeowners insurance, but keep in mind that you’ll need to pay out more in the event of a loss. If a windstorm causes a tree to fall onto a covered structure or blocks your driveway, homeowners insurance will pay up to $1,000 to remove it from your property. You would also be reimbursed for property damage caused by the fallen tree. Further coverage may be available to help you restore your home after a tornado.

There are many preventive measures you can take to eliminate the risk of wind damage to the roof. The most important thing you can do is to trim all branches that are sitting on top of your roof. If you have a tree hanging over your house, this is a disaster waiting to happen. All it would take is a few strong winds to collapse the tree and end up collapsing your roof. Yes, whether you're a tenant or a homeowner, home insurance policies generally cover damage that results from high winds or a tornado.

How much wind damage does it take to replace a roof?

Consult your home insurance policy to make sure that you’re protected in the event of severe weather. The dwelling coverage in your home insurance policy covers most types of wind damage, from tornadoes to nor’easters. Homeowner and business insurance is very complex and is generally only understood by insurance professionals and attorneys who have specialized knowledge and expertise. Wind damage coverage and the wording used in policies vary from one insurance company to another. If you have a wind damage claim, whether it’s for your home or business property, it is important that you understand exactly what is and is not covered. Insurance companies are notorious for either underpaying or outright refusing to pay claims.

You most likely have a leak caused by wind driven rain if your roof does not leak in every rain storm. If you had a true problem with your flashing or shingles, it would leak every time and it would most likely leak in the same spot too. The HO 3 only covers loss from rain, snow, sleet, sand, or dust to personal property inside a building under limited circumstances. Specifically, the direct force of wind or hail must first damage the building and cause an opening in a roof or wall. You may have a separate Wind and Hail Deductible on your property policy.

Hail and Wind Deductibles

One glance at your homeowners insurance policy documents and you might feel like you’re wading through alphabet soup.... After hurricanes, insurance companies face hundreds of millions of dollars in claims and more. From arguing that damage from a hurricane is not included in your policy to finding loopholes that leave certain portions of the damage out, there are many ways to get shortchanged. Before you mentally prepare to file a claim, keep the following in mind to ensure you’re aware of how insurance companies handle wind versus flood damage. Wind mitigation discounts to homeowners who’ve taken the proper steps to prevent hurricanes from damaging their homes. This includes installing wind-resistant windows and doors, as well as a hip roof that helps deflect heavy winds away from your house.

Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance. Don’t let your insurance provider brush your case aside or pass the blame to another carrier. Disputing with insurance companies can get messy, but you shouldn’t have to go through the ringer alone.

The wind and hail exclusion is probably not your best choice unless you have a rainy day fund that could pay for a complete rebuild of your home and then some. Windstorm, wind, or wind and hail deductibles - Can pay for any damage caused by wind storms, such as thunderstorms and straight-line winds, wind and hail, and hurricanes and tropical storms. For Inland homeowners, wind insurance is typically included in their base homeowners insurance policy. Your home insurance is there to pay for roof-related damages, but only for covered perils such as damages from severe weather, falling objects or fire. Your homeowners insurance does not typically cover damages or leaks caused because an older or poorly maintained roof is failing.

Large-scale, surface ocean currents are driven by global wind systems that are fueled by energy from the sun. These currents transfer heat from the tropics to the Polar Regions, influencing local and global climate. Change the wind stress, and the thermohaline circulation will change; alter thermohaline forcing, and the wind-driven currents will also change. It is because of thermohaline forcing that wind-driven currents are relegated to the upper ocean — in unstratified water they would extend to the bottom. Lawsuit against their insurance company for disputes over breaches of contract, denied claims, or underpaid reimbursements. Endorsement to your policy called law and ordinance coverage, which helps to cover those additional expenses related to meeting updated building codes.

No comments:

Post a Comment